The Chart of Accounts in SAP: A Comprehensive Guide

The heart of any financial accounting system is a well-structured chart of accounts (COA). In SAP, the COA plays a vital role in organizing and recording all your financial transactions. This blog serves as a comprehensive guide for anyone who wants to understand the ins and outs of the Chart of accounts in SAP .

What is a Chart of Accounts (COA) in SAP?

The chart of accounts in SAP is a structured listing of all general ledger (G/L) accounts used by a company code. Each account within the COA has a unique identifier (account number), a descriptive name, and control features that define its functionality. The COA essentially serves as the foundation for recording, classifying, and reporting your financial data within the SAP system.

Key Components of the SAP Chart of Accounts

- Account Number: A unique alphanumeric code assigned to each G/L account.

- Account Name: A descriptive name that clearly identifies the purpose of the account (e.g., Cash at Bank, Accounts Receivable, Inventory).

- Account Group: A category assigned to an account based on its functionality (e.g., Assets, Liabilities, Equity, Revenue, Expenses). Account groups help with grouping accounts for reporting purposes and often determine the numbering sequence for accounts.

- Control Features: These define how an account can be used within the system. Examples include specifying if an account can have a balance, if it can be used for postings, or if it requires additional information during transactions.

Types of Charts of Accounts in SAP

There are three primary types of charts of accounts used in SAP:

- Operating Chart of Accounts (Operational COA): This is the most commonly used COA, containing G/L accounts for recording day-to-day business transactions within a company code.

- Group Chart of Accounts: This COA is used for consolidation purposes in organizations with multiple company codes. It allows for the consolidation of financial statements from different company codes using a common set of accounts.

- Country-Specific Chart of Accounts: Some countries have specific legal or regulatory requirements for financial reporting. SAP offers country-specific COAs that comply with these local regulations.

Benefits of a Well-Defined Chart of Accounts

- Improved Accuracy: A well-structured COA minimizes errors by ensuring clear account definitions and proper transaction recording.

- Enhanced Reporting: The COA forms the basis for generating financial reports. A well-defined COA simplifies the creation of accurate and informative financial statements.

- Streamlined Analysis: The organization of accounts facilitates financial analysis by allowing you to easily group and compare transactions of similar nature.

- Regulatory Compliance: The COA can be customized to meet specific industry or country-specific accounting regulations.

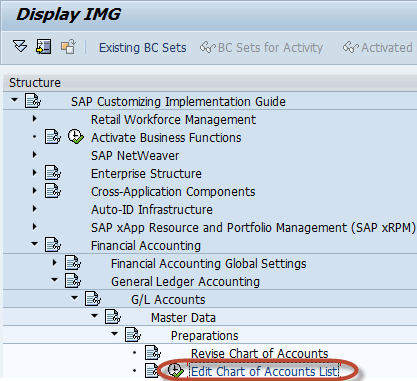

How to Manage?

The SAP system provides functionalities for creating, modifying, and managing your chart of accounts. This is typically done by authorized personnel within the finance department. Here are some resources for managing your COA in SAP:

- Transaction Code: SK01 is commonly used to create and maintain G/L accounts within the chart of accounts.

- FI (Financial Accounting) module within SAP provides functionalities related to managing the chart of accounts and general ledger activities.

Conclusion

The chart of accounts serves as the backbone of your financial data management in SAP. Understanding its structure, components, and functionalities is crucial for any organization that utilizes SAP for financial accounting. By maintaining a well-defined and organized COA, you can ensure accurate financial reporting, streamlined analysis, and simplified compliance with accounting regulations.

YOU MAY BE INTERESTED IN:

Create and Consume Business Add-in(BAdI) in ABAP