The expression “financial year” is central in money, bookkeeping, and business activities. It decides how associations and states plan, execute, and report their monetary exercises. This article investigates the importance of a monetary year, its importance, how it differs around the world, and its effect on organizations and people.

What is a Fiscal Year?

A monetary year (FY) is a year time span involved by organizations and legislatures for monetary revealing and planning. Not at all like the schedule year, which runs from January 1 to December 31, a financial year can begin and end on any dates, contingent upon the association’s inclinations or administrative necessities.

For example:

- The U.S. national government’s financial year starts on October 1 and closures on September 30 of the next year.

- Numerous companies adjust their financial years to the schedule year, running from January 1 to December 31.

- Different organizations could pick an alternate financial year, for example, April 1 to Walk 31, normal in nations like India.

Importance of a Fiscal Year

1.Financial Reporting and Analysis

Organizations and legislatures utilize the monetary year to deliver steady fiscal reports, including pay explanations, asset reports, and income articulations. These records empower partners to investigate monetary wellbeing and execution.

- Tax collection

Monetary years frequently decide charge cutoff times and recording periods. For instance, organizations in India should plan government forms for the monetary year beginning April 1 and finishing Walk - Budgeting and Forecasting

A monetary year helps associations in setting spending plans, estimating incomes, and arranging uses. It guarantees a precise way to deal with monetary preparation. - Operational Alignment

For organizations working in enterprises with occasional patterns, the monetary year can be customized to line up with their most active or most pertinent periods. For instance, retail organizations could pick financial years finishing after the Christmas shopping season to remember top income for their yearly reports.

How Fiscal Years Differ Globally

Various nations and associations take on monetary years in light of social, administrative, or financial contemplations.

- United States

- Central Government: October 1 – September 30.

- Partnerships: Fluctuates; many utilize the schedule year (January 1 – December 31).

- India

- The monetary year runs from April 1 to Walk 31.

- Organizations and people should record charges as per this cycle.

- United Kingdom

- The public authority’s monetary year is April 6 to April 5, an exceptional construction established in verifiable expense rehearses.

- Australia

- The monetary year traverses July 1 to June 30.

- Japan

- Monetary year: April 1 to Walk 31, lining up with the school year and the beginning of the cherry bloom season.

- China

- Ordinarily follows the schedule year for monetary purposes.

How Businesses Choose Their Fiscal Year

Organizations have the adaptability to pick their financial year in light of functional requirements, however this decision should follow lawful and administrative principles in their nation of activity.

Factors impacting the decision include:

- Industry Patterns: Retail organizations might pick financial years finishing after key deals periods, for example, the Christmas season.

- Charge Contemplations: A financial year lined up with charge cutoff times can work on consistence.

- Functional Cycles: Organizations in farming or the travel industry could adjust financial years to occasional pinnacles.

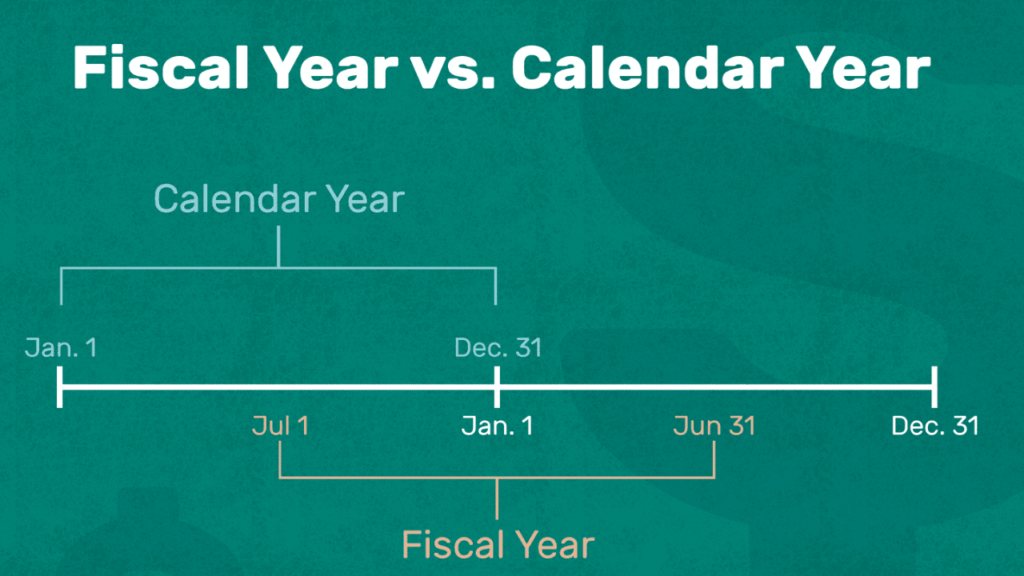

Fiscal Year vs. Calendar Year

While a calendar year always begins on January 1 and ends on December 31, a fiscal year can start and end on any dates as long as it spans 12 months.

Key Differences:

| Aspect | Fiscal Year | Calendar Year |

|---|

| Definition | Customizable 12-month period | January 1 – December 31 |

| Flexibility | High | Fixed |

| Purpose | Tailored to business needs | Universal standard |

| Examples | April 1 – March 31 (India) | January 1 – December 31 |

The Role of Fiscal Years in Business Operations

A fiscal year affects various aspects of a business, including:

- Bookkeeping Practices

Organizations should close their books toward the finish of their monetary year, guaranteeing precise records for examiners and assessment specialists. - Execution Assessment

A monetary year gives a proper period to quantify achievement or recognize difficulties, directing future systems. - Consistence and Reviewing

Administrative bodies frequently expect organizations to submit budget reports in light of their monetary year. Rebelliousness can prompt punishments.

Challenges of Managing a Fiscal Year

While the monetary year carries construction to monetary administration, it additionally presents difficulties:

- Intricacy for Worldwide Enterprises: Working across nations with various monetary years can muddle announcing.

- Skewed Revealing Cycles: Organizations with a financial year contrasting from their accomplices or clients might confront synchronization issues.

- Adapting to Occasional Varieties: Organizations in exceptionally occasional businesses should guarantee their monetary year catches top periods.Monetary Year in Individual accounting

Fiscal Year in Personal Finance

For individuals, the fiscal year plays a significant role in tax planning and compliance. Governments often use the fiscal year to define tax filing deadlines and eligibility for tax benefits.

Adapting to Changes in Fiscal Years

Associations might change their financial year for key reasons, for example, lining up with new business sectors or administrative changes. Nonetheless, such moves require cautious wanting to stay away from disturbances in announcing and tasks.

Future Trends in Fiscal Year Practices

With globalization and advancing strategic approaches, the idea of the financial year might keep on adjusting. Key patterns include:

Normalization Across Boundaries: Endeavors to adjust financial years universally could work on activities for worldwide organizations.

Computerized Change: High level bookkeeping programming considers continuous detailing, diminishing dependence on fixed monetary year-end dates.

Maintainability Mix: A few associations are integrating natural measurements into their financial revealing cycles.

Understanding the Fiscal Year: Definition, Importance, and Global Perspectives

The term “fiscal year” is fundamental in finance, accounting, and business operations. It determines how organizations and governments plan, execute, and report their financial activities. This article explores the meaning of a fiscal year, its significance, how it varies worldwide, and its impact on businesses and individuals.

What is a Fiscal Year?

A fiscal year (FY) is a 12-month period used by businesses and governments for financial reporting and budgeting. Unlike the calendar year, which runs from January 1 to December 31, a fiscal year can start and end on any dates, depending on the organization’s preferences or regulatory requirements.

For instance:

- The U.S. federal government’s fiscal year begins on October 1 and ends on September 30 of the following year.

- Many corporations align their fiscal years with the calendar year, running from January 1 to December 31.

- Other companies might choose a different fiscal year, such as April 1 to March 31, common in countries like India.

Importance of a Fiscal Year

The fiscal year serves as a structured period to evaluate financial performance, manage budgets, and plan for the future. Its significance lies in the following areas:

1. Financial Reporting and Analysis

Companies and governments use the fiscal year to produce consistent financial statements, including income statements, balance sheets, and cash flow statements. These records enable stakeholders to analyze financial health and performance.

2. Taxation

Fiscal years often determine tax deadlines and filing periods. For example, businesses in India must prepare tax returns for the fiscal year starting April 1 and ending March 31.

3. Budgeting and Forecasting

A fiscal year aids organizations in setting budgets, forecasting revenues, and planning expenditures. It ensures a systematic approach to financial planning.

4. Operational Alignment

For businesses operating in industries with seasonal trends, the fiscal year can be tailored to align with their busiest or most relevant periods. For example, retail companies might choose fiscal years ending after the holiday shopping season to include peak revenue in their annual reports.

How Fiscal Years Differ Globally

Different countries and organizations adopt fiscal years based on cultural, regulatory, or economic considerations.

United States

- Federal Government: October 1 – September 30.

- Corporations: Varies; many use the calendar year (January 1 – December 31).

India

- The fiscal year runs from April 1 to March 31.

- Businesses and individuals must file taxes according to this cycle.

United Kingdom

- The government’s fiscal year is April 6 to April 5, a unique structure rooted in historical tax practices.

Australia

- The fiscal year spans July 1 to June 30.

Japan

- Fiscal year: April 1 to March 31, aligning with the school year and the start of the cherry blossom season.

China

- Typically follows the calendar year for fiscal purposes.

How Businesses Choose Their Fiscal Year

Businesses have the flexibility to choose their fiscal year based on operational needs, but this choice must comply with legal and regulatory standards in their country of operation.

Factors influencing the choice include:

- Industry Trends: Retail companies may choose fiscal years ending after key sales periods, such as the holiday season.

- Tax Considerations: A fiscal year aligned with tax deadlines can simplify compliance.

- Operational Cycles: Companies in agriculture or tourism might align fiscal years with seasonal peaks.

Fiscal Year vs. Calendar Year

While a calendar year always begins on January 1 and ends on December 31, a fiscal year can start and end on any dates as long as it spans 12 months.

Key Differences:

| Aspect | Fiscal Year | Calendar Year |

|---|---|---|

| Definition | Customizable 12-month period | January 1 – December 31 |

| Flexibility | High | Fixed |

| Purpose | Tailored to business needs | Universal standard |

| Examples | April 1 – March 31 (India) | January 1 – December 31 |

The Role of Fiscal Years in Business Operations

A fiscal year affects various aspects of a business, including:

1. Accounting Practices

Companies must close their books at the end of their fiscal year, ensuring accurate records for auditors and tax authorities.

2. Performance Evaluation

A fiscal year provides a fixed period to measure success or identify challenges, guiding future strategies.

3. Compliance and Auditing

Regulatory bodies often require businesses to submit financial statements based on their fiscal year. Non-compliance can lead to penalties.

Challenges of Managing a Fiscal Year

While the fiscal year brings structure to financial management, it also presents challenges:

- Complexity for Multinational Corporations: Operating across countries with different fiscal years can complicate reporting.

- Misaligned Reporting Cycles: Companies with a fiscal year differing from their partners or clients may face synchronization issues.

- Adjusting for Seasonal Variations: Businesses in highly seasonal industries must ensure their fiscal year captures peak periods.

Fiscal Year in Personal Finance

For individuals, the fiscal year plays a significant role in tax planning and compliance. Governments often use the fiscal year to define tax filing deadlines and eligibility for tax benefits.

Adapting to Changes in Fiscal Years

Organizations may change their fiscal year for strategic reasons, such as aligning with new markets or regulatory changes. However, such shifts require careful planning to avoid disruptions in reporting and operations.

Future Trends in Fiscal Year Practices

With globalization and evolving business practices, the concept of the fiscal year may continue to adapt. Key trends include:

- Standardization Across Borders: Efforts to align fiscal years internationally could simplify operations for global businesses.

- Digital Transformation: Advanced accounting software allows for real-time reporting, reducing reliance on fixed fiscal year-end dates.

- Sustainability Integration: Some organizations are incorporating environmental metrics into their fiscal reporting cycles.

Conclusion

The monetary year is a foundation of monetary administration, impacting tax collection, planning, and vital preparation. While its construction changes across nations and businesses, its job stays reliable: to give a methodical structure to assessing monetary execution.

Whether you’re an entrepreneur, a monetary expert, or a singular citizen, understanding the monetary year is fundamental for viable monetary navigation.

You may be interested in:

A Deep Dive into SAP API Management

Integration cloud system to HANA Cloud Platform using Cloud Connector