What is Financial Planning and Analysis (FP&A)?

Financial Planning and Analysis (FP&A) specialists are in charge of a company’s financial planning, budgeting, and forecasting process, which helps the executive team and board of directors make critical decisions. These employees gather, prepare, and analyze financial data from all around the company in order to develop reports that provide data-driven answers to business concerns. The FP&A department is becoming more forward-thinking. It employs best practices to concentrate not just on what occurred or is occurring, but also on why it is occurring and what is expected to occur in the future.

Financial Planning and Analysis director

An FP&A director or analyst should be a strategic counselor to the CFO or controller and a business partner for the entire organization, working closely with various business divisions. By finding opportunities for efficiency, savings, and investment, these professionals assist finance department executives in maintaining and avoiding additional costs.

In recent years, the function of FP&A has changed. FP&A analysts used to be solely concerned with recording and reporting financial outcomes, as well as anticipating future sales and earnings based on historical financial data. However, today’s flow of data and the technology that helps analysts make sense of it has enabled FP&A to shift from reactive to proactive work, giving smart projections and analyses that directly impact the business’s future.

Financial Planning and Analysis Skills

An FP&A analyst & director must be a natural mathematician with a desire to crunch numbers. It’s no surprise that many persons in this position have previously worked as accountants. However, sales, marketing, human resources, and operations specialists in this industry must be comfortable diving into complex and different data sets.

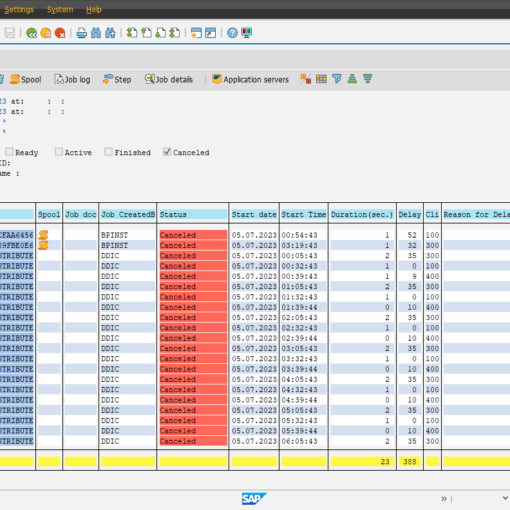

Spreadsheets are a necessary tool for interpreting data, thus FP&A professionals should be proficient in Microsoft Excel or a similar program. They must be familiar with the formulas and procedures that will allow them to aggregate and manipulate raw data in order to generate important reports. They should be familiar with the fundamentals of ERP systems, as well as how this software may help with more complicated reporting and analysis.

FP&A team members should have good business partnering skills because they must communicate and work with colleagues from throughout the enterprise. Business partnership skills include the ability to collaborate well with others and understand their business aims and goals, as well as the ability to gain a thorough understanding of the organization and its processes and transform large amounts of data into effectively consumable reports. Finally, FP&A employees must have exceptional problem-solving skills, as they must overcome the difficulties that arise with aggregating and reconciling financial data.

FP&A Responsibilities

- P&L: Profit and Loss (P&L) statements, board reports, and management reports such as variance reports, which track budget vs. actual spend time by department, and cash flow statements are all produced by the FP&A team. Collecting data from many departments (therefore the business partnership skills) and then confirming and integrating that data is required to complete these statements. This is how the FP&A team calculates important financial indicators that will show in these statements, such as the debt-to-equity ratio and current ratio.

- Budgeting: Planning the budget and estimating the company‘s future financial performance are two of FP&A’s most forward-looking responsibilities. Budgeting requires parsing through financial records to determine how to allocate money. Forecasting necessitates the development of financial models that take into consideration trends within the company as well as changes in the broader industry and economy that may have an impact on sales and profit. A smaller company might anticipate for 4-8 months, while a larger company might look out 1-3 years. More firms are shifting to continuous planning and rolling projections, continuously analyzing the newest numbers to make adjustments, rather than a yearly or quarterly event.

- Profit Margins: Financial statement analysis is frequently performed by FP&A experts to determine which product lines or services have the best profit margins or contribute the most to net profit. They may also break down the cost and income or profit made by each department within the organization. Another typical task for FP&A team members is evaluating a company’s working capital investments and identifying new investment opportunities.

- Scenario Planning: Scenario planning is a sort of financial modeling in which FP&A professionals create best-case, expected case, and worst case scenarios by plugging in various sales and order volume numbers to evaluate how they affect the company’s financial condition. Based on those results, the team can identify steps it would take in response to different outcomes, better preparing a business for the future. “Extremely or very effective” FP&A teams were more likely to have predictive capabilities. These forecasts can also aid in the planning of capital expenditures and other investments.

- Ad-hoc reporting: These on-demand reports, which are usually requested by the CFO or controller, give a more in-depth look into a certain KPI or business department. To find the exact information that the executive need, an analyst or director may need to pick figures from a variety of bigger reports. This reporting and modeling provide the FP&A team with the information they need to make quick, accurate, and actionable recommendations to senior management, especially if it’s done on a regular basis.

FP&A Manager

The FP&A Manager is in charge of business forecasting and corresponding budgets as well as performance-based analyses. They must look for data trends or deviations in the company’s financial records, and then devise methods for improving the company’s performance in order to meet its objectives and map out future goals and plans.

In the forecasting process, the FP&A Manager seeks to predict future financial outcomes by taking into account economic and business trends as well as prior firm performance. Financial analytics, unlike accountants, are in charge of studying, analyzing, and assessing the entirety of a corporation’s financial activities, as well as planning out the company’s financial future.

FP&A Manager Responsibilities

- Seeing if the organization is making the best use of its assets and investments.

- Estimate the company’s overall financial health, mainly by using key financial ratios.

- Creating internal reports for executives to help them make decisions.

- Budget preparation in collaboration with other departments.

- Financial models and detailed estimates of the company’s future activities are created, updated, and maintained.

- Perform variance analysis to explain changes in performance and give ideas for future improvements by comparing historical outcomes to budgets and forecasts.

- Being able to spot potential expansion or growth prospects for the company.

Benefits of Effective FP&A:

- Improved Decision-Making: FP&A provides timely and accurate financial information, enabling stakeholders to make informed decisions based on data-driven insights. By considering various scenarios and analyzing potential outcomes, organizations can minimize risks and optimize resource allocation.

- Enhanced Financial Performance: FP&A identifies areas of inefficiency, cost overruns, and revenue leakage through comprehensive analysis. With these insights, organizations can implement corrective measures and drive financial performance improvement across departments.

- Strategic Alignment: FP&A aligns financial goals with overall business objectives, ensuring that financial strategies support the organization’s long-term vision. By actively contributing to strategic planning, FP&A helps foster a culture of accountability and financial discipline throughout the organization.

- Risk Management: Through rigorous analysis and scenario modeling, FP&A identifies potential financial risks and assists in developing risk mitigation strategies. This proactive approach helps organizations navigate uncertainties and build resilience.

- Stakeholder Communication: FP&A teams play a critical role in communicating financial performance and insights to stakeholders, including executives, board members, and investors. Clear and concise reporting facilitates transparency and fosters trust among stakeholders.

Conclusion:

Financial Planning and Analysis (FP&A) is a vital function within organizations that drives informed decision-making, optimizes financial performance, and supports strategic planning. By leveraging financial data, analysis, and modeling techniques, FP&A empowers organizations to navigate challenges, seize opportunities, and achieve long-term financial success. As businesses continue to evolve in an increasingly complex environment, the role of FP&A becomes even more critical in shaping and sustaining organizational growth and profitability.