Interest estimation setup should be possible by two strategies i.e Interest calculation on account balances and SAP Interest calculation on areas.

Interest calculation configuration steps

Step 1: – Define the interest calculation procedure

2: – Prepare account balance interest calculation

3: – Define reference interest rates

4: – Define Time based terms

5: – Enter interest values

6: – Create G/L Accounts

7: – Prepare G/L account balances interest calculation configuration procedure

The following steps describe the calculation of interest.

Step 1: – Define the interest calculation procedure

- SAP IMG Path: – SPRO > Financial Accounting > Accounts Receivable & Accounts Payable >Business Transactions > Interest Calculation > Interest Calculation Global Settings > Define Interest Calculation Types

- Transaction Code: – OB46

Click on “new entries” and update the following entries

- Enter your interest indicator in the Int ID field

- Enter a description of your interest indicator

- Select interest calculation type .i.e Balance interest calculation type or item interest calculation type

Click on the save symbol to save the designed information.

Step 2: – Prepare account balance interest calculation

- IMG Path: – SPRO > Financial Accounting > Accounts Receivable & Accounts Payable >Business Transactions > Interest Calculation > Interest Calculation Global Settings > Prepare Account Balance Interest Calculation

- Transaction code: – OBAA

Click on new entries and update the following entries

- Enter your interest calculation indicator

- Update the period determination i.e interest calculation frequency and settlement day

- Select appropriate calendar type (B- 30/360, G – 28,…,31/365)

- Select output control for printing form and terms of payment for posting

Step 3: – Define reference interest rates

- Path: SPRO > Financial Accounting > Accounts Receivable & Accounts Payable >Business Transactions > Interest Calculation > Interest Calculation > Define Reference Interest Rates

Transaction Code: – OBAC

Click on new sections and keep up with the accompanying passages

Enter your reference loan cost key, long text, Portrayal, date from, substantial money of ref.int. rate.

Click on the save symbol to save the information.

Step 4: – Define Time based terms

- Path: SPRO > Financial Accounting > Accounts Receivable & Accounts Payable >Business Transactions > Interest Calculation > Interest Calculation > Define Time-Based Terms.

Transaction Code: – OB81

Pick new sections and update the accompanying passages

- Enter your interest calculation indicator key in the int.cal.indicator field

- Update the fields currency key, Eff. from, sequential number

- Select the transaction type from the list

- Enter the Reference interest rate (Check step 3)

Pick the save button to save the information.

Step 5: – Enter interest values

SPRO > SAP Reference IMG (F5) > Financial Accounting > Accounts Receivable & Accounts Payable >Business Transactions > Interest Calculation > Interest Calculation > Enter Interest Values.

Transaction Code: – OB83

- Enter the reference loan cost key in the reference field

- Update the legitimate from and loan cost rate

Click on the save symbol to save the information.

Step 6: – Create G/L Accounts

Path: – IMG > Financial accounting > G/L Accounting > G/L Accounts > Master Data–> Preparations > GL Account Creation and Processing > Edit G/L Account

Transaction Code: Fs00

Make G/L records for Term advances, Interest paid, Interest got, credit

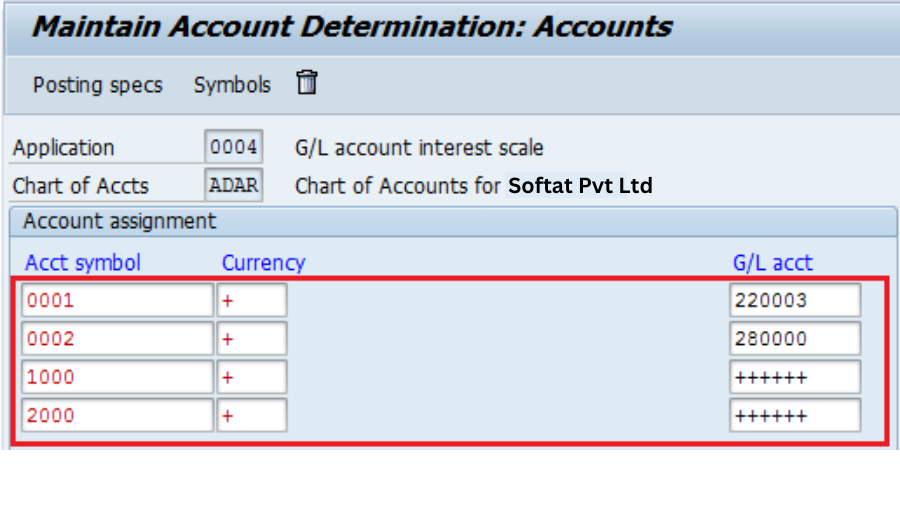

Step 7: – Prepare G/L account balances interest calculation procedure

SAP IMG Path: –

SPRO > Financial Accounting > General Ledger Accounting > Business Transactions > Bank Account Interest Calculation > Interest Posting > Prepare G/L Account Balance Interest Calculation

Transaction Code: – OBV2

Click on the Records button and enter the outline of records key and press enter to proceed

Update the record images in the Acct image field, G/L Records as displayed underneath. In the wake of refreshing the expected information click on posting specs

Click on the posting specs button, then select the alter choice and afterward click on make button and update the accompanying data

Click on the save symbol to save the arranged information. Effectively you have arranged interest computation in SAP.

YOU MAY BE INTERESTED IN

A Comprehensive Guide to SAP ABAP Training Online

Bridging the Gap: Integrating ABAP with Other Cloud Services