SAP, one of the world’s biggest programming organizations, is a central member in the undertaking asset arranging (ERP) programming area. With a worldwide impression and a market-driving position, SAP’s portion cost is a basic gauge of the two its monetary wellbeing and the more extensive innovation market. SAP shares are exchanged on different trades, yet one of the main stages is Xetra – a completely electronic exchanging framework worked by the Frankfurt Stock Trade. In this blog, we’ll investigate the SAP share cost on Xetra, how it acts, the key variables impacting it, and what financial backers ought to keep an eye out for.

What is Xetra?

Xetra, short for Trade Electronic Exchanging, is a robotized and electronic exchanging stage situated in Frankfurt, Germany. It is one of Europe’s driving exchanging scenes, dealing with more than 80% of German values exchanging, including significant organizations like SAP. Not at all like customary stock trades with an actual exchanging floor, Xetra works totally through electronic frameworks, offering rapid, effective, and straightforward exchanging.

Xetra has turned into a fundamental center for SAP’s stock because of its consistent incorporation into the European monetary environment. For financial backers, it offers an opportunity to draw in with SAP’s exhibition progressively and execute exchanges with negligible dormancy.

The Role of SAP in the Technology Sector

SAP, settled in Walldorf, Germany, is a worldwide forerunner in big business programming, with an especially impressive presence in ERP arrangements. The organization serves large number of clients across ventures like assembling, retail, monetary administrations, and medical care. SAP’s product arrangements are vital to business activities, assisting organizations with overseeing all that from supply chains and HR to funds and client relations.

As of late, SAP has made a huge push towards distributed computing, changing its plan of action to zero in more on cloud-based arrangements like SAP S/4HANA and SAP Business Innovation Stage (BTP). This progress to the cloud has been a vital piece of its methodology to remain significant in a quickly developing innovation scene.

Given SAP’s noticeable quality in the venture programming space, its portion cost on Xetra is firmly watched by institutional financial backers, experts, and retail dealers the same. Developments in its stock cost offer an impression of how the market sees the organization’s ongoing monetary wellbeing and its possibilities in the undeniably serious programming and distributed computing markets.

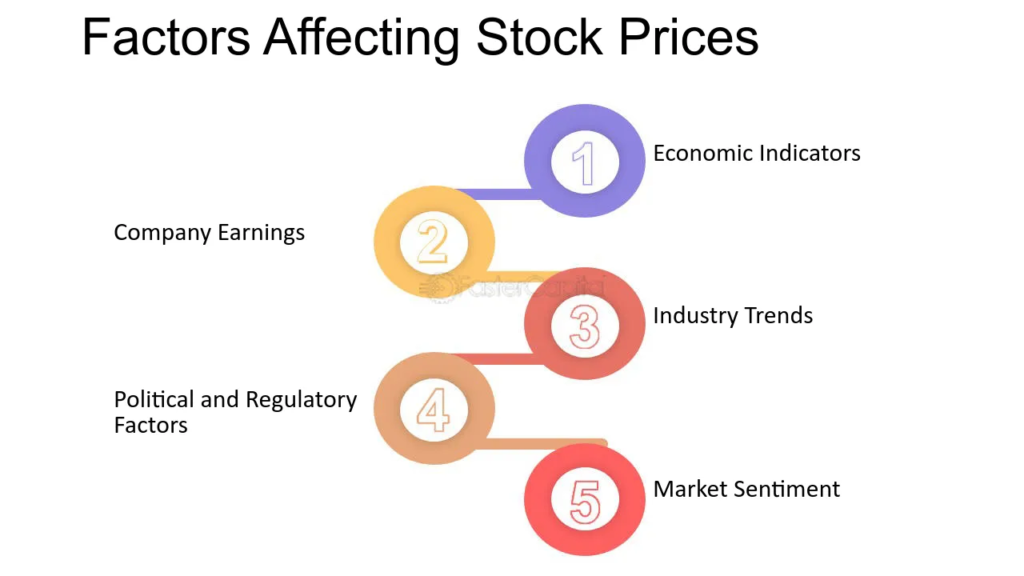

Factors Affecting SAP’s Share Price on Xetra

The SAP share cost on Xetra is impacted by different variables, from organization explicit news to more extensive macroeconomic patterns. Understanding these drivers can give significant experiences to financial backers hoping to follow or put resources into SAP stock.

- Quarterly Income Reports

One of the main drivers of SAP’s stock cost is its quarterly income reports. These monetary revelations uncover pivotal information on the organization’s income, working pay, cloud membership development, and other key execution markers (KPIs). Positive profit reports, particularly those that surpass experts’ assumptions, can prompt an increase in SAP’s portion cost. For example, in the event that SAP reports a higher-than-anticipated development rate in cloud income, financial backers might see this as an indication of the organization’s effective computerized change, prompting expanded financial backer certainty and a resulting ascend in the stock cost.

Alternately, disheartening income can make the contrary difference. For instance, if SAP somehow happened to report a drop in cloud reception or more slow than-anticipated development, financial backers could lose certainty, making the stock cost fall. On Xetra, such developments can happen rapidly as merchants respond to the news continuously, prompting changes in the offer cost.

- Item Advancement and Key Acquisitions

SAP’s proceeded with development and its capacity to carry out new, market-driving items assume a critical part in molding its stock cost. For instance, the progress of SAP S/4HANA, the organization’s cutting edge ERP suite, has been a vital figure the organization’s development direction. Positive gathering and reception of such items can drive SAP’s stock cost higher, as they frequently signal solid interest and future income development.

Vital acquisitions likewise influence SAP’s portion cost. At the point when SAP obtains more modest tech organizations, especially in regions, for example, computerized reasoning, information examination, or distributed computing, the market frequently sees these moves as a sign of SAP’s obligation to growing its abilities and item portfolio. These acquisitions, whenever saw as accretive to Drain’s drawn out development, can bring about an expansion in the offer cost on Xetra. Notwithstanding, on the off chance that a procurement is viewed as overrated or decisively skewed with SAP’s objectives, it could make the contrary difference.

- Macroeconomic Patterns

Macroeconomic factors, for example, loan costs, expansion, and international occasions likewise influence SAP’s stock cost. For instance, financial slumps or downturns might prompt decreased IT spending, which could affect interest for SAP’s product and administrations. Then again, during times areas of strength for of development, organizations are bound to put resources into computerized change drives, which could support interest for SAP’s cloud and ERP arrangements.

What’s more, cash vacillations can assume a part in SAP’s stock cost developments. As a global organization, SAP creates income in different monetary forms. A solid euro, for instance, could hurt its benefit in abroad business sectors, prompting negative feeling and a decrease in its portion cost on Xetra. On the other hand, a more fragile euro could make the contrary difference.

- Cutthroat Scene

The cutthroat climate likewise assumes an essential part in forming SAP’s portion cost on Xetra. SAP faces critical contest from other worldwide tech monsters like Microsoft, Prophet, and Salesforce, which are all competing for predominance in the distributed computing and ERP markets. Any critical moves by these contenders, for example, the send off of another item or a cost cut, could affect SAP’s market position and impact financial backer opinion toward its stock.

For instance, assuming that a contender presents a leading edge item that draws in a huge portion of SAP’s client base, the market might respond adversely, making SAP’s portion cost fall. Then again, on the off chance that SAP outflanks its rivals, its stock could profit from a positive change in market opinion.

- Cloud Change and Advanced Change

A basic component of SAP’s continuous achievement is its shift to the cloud. The organization’s advance toward cloud-based ERP arrangements, artificial intelligence driven examination, and information the board apparatuses is important for its more extensive computerized change methodology. Financial backers intently screen the organization’s advancement around here, especially the development of its cloud business.

SAP’s cloud income is a vital sign of the organization’s capacity to adjust to showcase changes. The outcome of its cloud contributions – like SAP S/4HANA Cloud, SAP SuccessFactors, and SAP Ariba – can fundamentally affect the organization’s future development and its stock cost. On the other hand, in the event that SAP battles to rival cloud-first players like Salesforce and Microsoft Purplish blue, it might confront difficulties in keeping up with financial backer certainty, which could prompt a decrease in its portion cost.

- Financial backer Feeling and Market Patterns

Financial backer feeling and more extensive market patterns can in some cases impact SAP’s portion cost. For instance, during times of market instability, stock costs of significant tech organizations like SAP can be dependent upon expansive market patterns, regardless of whether the organization’s basics stay solid. On the off chance that the market all in all is down because of macroeconomic feelings of trepidation, SAP’s portion cost on Xetra might stick to this same pattern, regardless of whether the organization is performing great.

Then again, during times of confidence about the tech area, SAP’s portion cost might profit from more extensive positive feeling, especially in the event that the organization is viewed as major areas of strength for a developing distributed computing market.

Tracking SAP’s Share Price on Xetra

Financial backers hoping to follow SAP’s portion cost on Xetra can do as such through various monetary stages and market information suppliers. Xetra offers continuous exchanging information, including the ongoing cost, 24-hour volume, bid/ask spreads, and authentic cost developments. By dissecting this information, financial backers can acquire bits of knowledge into the stock’s momentary unpredictability, long haul patterns, and generally market feeling.

Xetra’s straightforwardness and effectiveness make it an optimal stage for both institutional financial backers and retail merchants to screen and exchange SAP’s stock. The stage likewise offers an elevated degree of liquidity, guaranteeing that exchanges are executed quickly and precisely.

Conclusion: What’s Next for SAP and Its Share Price?

The SAP share cost on Xetra is impacted by a scope of elements, from profit results and item developments to macroeconomic patterns and serious tensions. As SAP proceeds with its computerized change, progressing from customary programming to a cloud-first model, its stock cost is probably going to be exceptionally delicate to improvements in its cloud business and its capacity to execute on its development methodology.

For financial backers, understanding these drivers and watching out for SAP’s exhibition on Xetra is fundamental for settling on informed choices. As the organization proceeds to improve and adjust to changing economic situations, the SAP share cost on Xetra will probably stay a vital sign of both the organization’s possibilities and the more extensive patterns in the tech area.

As SAP proceeds to develop and catch new open doors, especially in distributed computing and man-made consciousness, its portion cost will without a doubt be impacted by how effectively it can profit by these development regions. Financial backers ought to keep on checking the exhibition of SAP shares on Xetra and search for signals that will direct them in assessing the organization’s future potential.

You may be interested in:

A Deep Dive into SAP API Management

Integration cloud system to HANA Cloud Platform using Cloud Connector