In the fast-paced world of finance, effective cash management is paramount for businesses to thrive. SAP Cash Management, a powerful tool in the SAP suite, offers a robust solution for organizations to optimize their cash flow, enhance liquidity, and make informed financial decisions. In this comprehensive article, we’ll delve into the intricacies of Management, exploring its features, benefits, implementation, and best practices.

1. Introduction to SAP Cash Management

It is a dynamic financial solution designed to provide real-time visibility into an organization’s cash flow. It enables finance professionals to manage and control their cash positions efficiently. This robust system assists in optimizing cash utilization, reducing idle funds, and maximizing returns on investments.

2. The Importance of Cash Management

Effective cash management is the lifeblood of any business. It ensures that a company has enough liquidity to meet its short-term obligations while also planning for growth and expansion. Without proper cash management, an organization may face financial instability, missed opportunities, and increased borrowing costs.

3. Key Features of SAP Cash Management

It offers a wide array of features, including:

3.1 Real-time Cash Visibility

The system provides up-to-the-minute insights into your cash positions across various accounts, banks, and currencies.

3.2 Cash Flow Forecasting

Predict future cash flows with accuracy, allowing for proactive decision-making.

3.3 Liquidity Planning

Optimize your cash reserves and invest surplus funds intelligently.

3.4 Bank Connectivity

Effortlessly connect with multiple banks for seamless transactions and data retrieval.

4. Benefits of Implementing SAP Cash Management

By implementing it, your organization can reap several benefits, such as:

4.1 Improved Decision-making

Access to real-time data enables informed financial decisions.

4.2 Reduced Financial Risk

Identify and mitigate potential risks through comprehensive analysis.

4.3 Enhanced Efficiency

Streamline cash-related processes, reducing manual efforts and errors.

5. Getting Started: Implementing SAP Cash Management

The implementation of Management involves several crucial steps, including system setup, data integration, and user training. It’s essential to engage with experienced SAP consultants for a smooth transition.

6. Setting Up Your SAP Cash Management System

Configuring Management to align with your organization’s needs is a critical step. Customization ensures that the system addresses your specific cash management requirements.

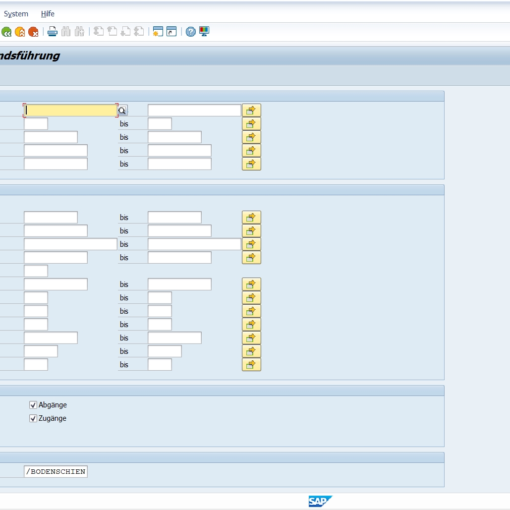

7. Navigating SAP Cash Management Interface

The user-friendly interface of it allows finance professionals to navigate the system seamlessly. Training sessions can help users maximize the software’s potential.

8. Cash Flow Forecasting with SAP

Accurate cash flow forecasting empowers businesses to allocate resources efficiently and plan for future investments. SAP Cash Management’s forecasting capabilities are second to none.

9. Treasury and Risk Management Integration

It can be seamlessly integrated with SAP Treasury and Risk Management solutions for a holistic financial management approach.

10. Reporting and Analytics with SAP Cash Management

Robust reporting tools enable you to gain deep insights into your cash flow data, facilitating data-driven decisions.

11. Enhancing Liquidity with SAP Cash Management

Discover how it can help optimize liquidity by intelligently managing your cash reserves and investments.

12. Compliance and Regulatory Considerations

Staying compliant with financial regulations is a top priority. Learn how SAP Cash Management can assist in adhering to regulatory requirements.

13. Common Challenges and How to Overcome Them

Explore the typical challenges faced during Management implementation and strategies to overcome them.

14. Real-Life Success Stories

Read about organizations that have successfully transformed their cash management processes with SAP Cash Management.

15. Conclusion: Unleash Your Financial Potential with SAP Cash Management

In conclusion, It is a game-changer for organizations seeking to optimize their cash flow, reduce financial risk, and make data-driven decisions. By implementing this powerful tool, businesses can unlock their full financial potential.

5 Unique FAQs

1. Is SAP Cash Management suitable for small businesses?

It is scalable and can be tailored to the needs of small, medium, and large enterprises.

2. How long does it take to implement Management?

The implementation timeline varies based on the complexity of your organization’s financial processes but typically ranges from a few months to a year.

3. Can Management integrate with other ERP systems?

Yes, It can be integrated with various ERP systems to ensure data consistency and accuracy.

4. What kind of training is required for Management users?

Users should undergo training to familiarize themselves with the system’s interface and functionalities. SAP offers training programs for this purpose.

5. How can I measure the ROI of implementing Management?

ROI can be measured through factors like improved cash flow, reduced borrowing costs, and increased operational efficiency.

Free Bonuses:

SAP Full Form & Definition of SAP ERP Software

Exploring the Benefits of SAP Consulting for Small Businesses